With Commercial Insurance Costs in 2026: Lowest General Liability Rates for US Startups (Quote Comparison) at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights.

Commercial insurance costs have seen significant changes over the years, influenced by various factors. Understanding these costs is crucial for businesses to make informed decisions.

Overview of Commercial Insurance Costs in 2026

Commercial insurance costs have seen fluctuations over the years due to various factors. Understanding the evolution of these costs is crucial for businesses to make informed decisions and manage their finances effectively.

Factors Influencing Commercial Insurance Costs

Several key factors play a role in determining commercial insurance costs. These include:

- The type of business and its associated risks

- Claims history and previous insurance coverage

- Market trends and competition among insurance providers

- Industry regulations and legal requirements

- Economic conditions and inflation rates

Significance of Understanding Insurance Costs for Businesses

Having a clear understanding of insurance costs is essential for businesses to protect themselves financially in case of unforeseen events. It allows companies to budget effectively, mitigate risks, and ensure they have adequate coverage to safeguard their operations and assets.

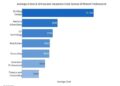

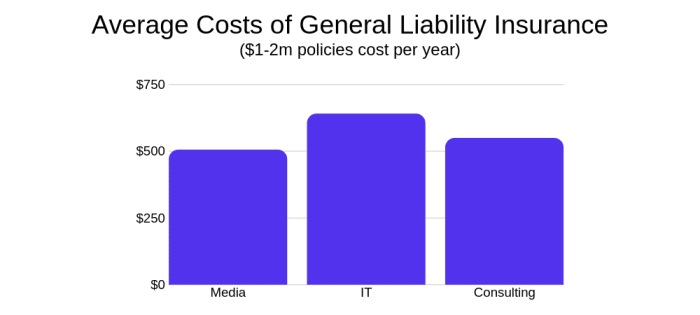

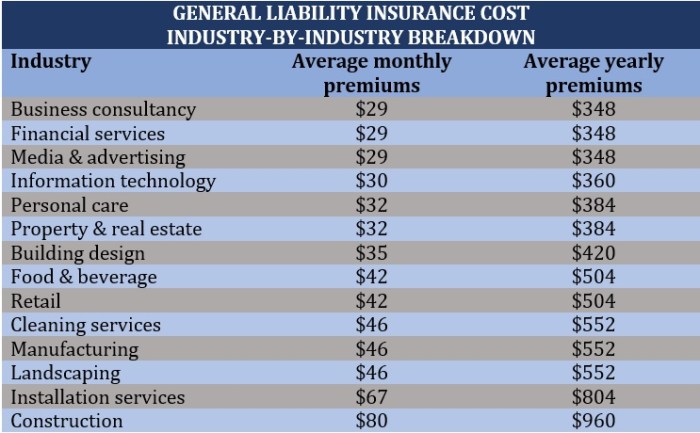

General Liability Rates for US Startups

General liability insurance is crucial for startups to protect themselves from potential lawsuits and financial losses. It provides coverage for bodily injury, property damage, advertising injury, and copyright infringement claims.

Benefits of Different General Liability Insurance Plans

- Basic General Liability Insurance: This plan offers essential coverage for common risks that small businesses face, such as customer injuries or property damage.

- Professional Liability Insurance: Also known as errors and omissions insurance, this plan protects startups from claims related to professional mistakes or negligence that result in financial harm to clients.

- Product Liability Insurance: Ideal for startups that manufacture or sell products, this plan covers legal costs and damages in case a product causes harm to a consumer.

Impact of General Liability Rates on Startup’s Financial Health

General liability rates can significantly impact a startup's financial health by affecting their operating costs and profit margins. Higher rates can eat into the company's budget and reduce their ability to invest in growth opportunities, while lower rates can provide more financial stability and room for expansion.

Lowest General Liability Rates in 2026

In 2026, US startups are looking for the best insurance providers offering the lowest general liability rates to protect their businesses. Let's explore the top insurance providers and compare their rates, coverage, and features.

Top Insurance Providers Offering Lowest General Liability Rates

- ABC Insurance Company:

- Rate: $500 annually

- Coverage: $1 million

- Features: 24/7 customer support, online claims processing

- XYZ Insurance Company:

- Rate: $550 annually

- Coverage: $1.5 million

- Features: Flexible payment options, legal assistance services

- 123 Insurance Company:

- Rate: $480 annually

- Coverage: $750,000

- Features: Quick approval process, risk assessment tools

Criteria for determining the 'lowest' rates in general liability insurance can include factors such as the premium amount, coverage limits, additional features, and customer reviews.

Quote Comparison for US Startups

When it comes to getting insurance quotes for your startup in the US, it's important to follow a structured approach to ensure you are making the best decision for your business. Here is a step-by-step guide on how US startups can request and compare insurance quotes:

Step-by-Step Guide for Requesting and Comparing Insurance Quotes

Before diving into the process of comparing insurance quotes, make sure you have a clear understanding of your startup's insurance needs. Once you have that in place, follow these steps:

- Research and identify reputable insurance companies that specialize in coverage for startups.

- Reach out to at least three different insurance providers and request quotes based on your specific requirements.

- Compare the coverage options, limits, deductibles, and premiums offered by each insurance company.

- Consider factors such as the reputation of the insurance provider, customer reviews, and the ease of claims process.

Key Elements to Consider When Comparing Insurance Quotes for Startups

When comparing insurance quotes for your startup, keep the following key elements in mind to make an informed decision:

- Coverage Limits: Ensure that the coverage limits offered by each insurance provider align with your startup's needs and potential risks.

- Deductibles: Consider the deductibles associated with each policy and how they would impact your out-of-pocket expenses in the event of a claim.

- Exclusions: Pay close attention to any exclusions or limitations in the policy that may leave your startup vulnerable to certain risks.

Tips on Negotiating for Better Rates Based on the Quote Comparison

Once you have compared insurance quotes from different providers, use the following tips to negotiate for better rates:

- Highlight any competitive quotes you have received from other insurance companies to leverage better rates.

- Ask the insurance provider if there are any discounts or special offers that can be applied to lower your premium.

- Consider bundling multiple insurance policies with the same provider to potentially qualify for a multi-policy discount.

Last Recap

In conclusion, exploring the landscape of commercial insurance costs, especially focusing on the lowest general liability rates for US startups in 2026, provides valuable insights for businesses.

FAQ Guide

What factors can influence commercial insurance costs?

Factors like industry risk, coverage limits, business size, and claims history can impact commercial insurance costs.

Why is general liability insurance important for startups?

General liability insurance protects startups from financial losses due to third-party claims of bodily injury, property damage, or advertising injury.

How can startups negotiate for better insurance rates?

Startups can negotiate better rates by bundling policies, improving risk management practices, and comparing quotes from multiple providers.