Starting off with Errors & Omissions (E&O) Insurance Cost Breakdown: Why US Consultants Pay ~$1,288/Year, this introductory paragraph aims to grab the attention of the readers, providing a brief overview of the topic in a captivating manner.

The following paragraph will delve deeper into the details and specifics of the subject matter.

Understanding Errors & Omissions (E&O) Insurance

Errors & Omissions (E&O) Insurance is a type of professional liability insurance that provides coverage for claims made by clients against consultants for inadequate work or negligent actions. It helps protect consultants from financial losses resulting from lawsuits related to professional services provided.E&O Insurance is crucial for consultants as it offers protection in cases where they make mistakes or fail to deliver the promised services.

Without this insurance, consultants may face significant financial burdens in the event of a lawsuit, including legal fees, settlements, and damages.

Comparison with Other Types of Business Insurance

E&O Insurance differs from other types of business insurance, such as General Liability Insurance, in that it specifically covers professional mistakes or errors in the services provided. While General Liability Insurance protects against bodily injury, property damage, and advertising injury, E&O Insurance focuses on the professional services aspect of the business.Additionally, E&O Insurance is more personalized and tailored to the specific risks faced by consultants in their line of work.

It provides coverage for claims that may not be covered by other types of insurance, making it a critical component of a consultant's risk management strategy.

Factors Influencing E&O Insurance Costs

When it comes to Errors & Omissions (E&O) Insurance costs, several key factors play a significant role in determining the premiums that consultants pay. Understanding these factors can help consultants make informed decisions about their coverage. Let's explore some of the main elements that influence E&O Insurance costs.

Type of Consulting Services

The type of consulting services offered by a consultant is a crucial factor in determining E&O Insurance premiums. Consultants providing services in high-risk industries such as finance, healthcare, or technology are more likely to face complex and costly claims. As a result, insurance providers may charge higher premiums to cover these increased risks.

Claims History and Coverage Limits

A consultant's claims history and chosen coverage limits also play a vital role in determining E&O Insurance costs. Consultants with a history of frequent or costly claims are considered higher risk by insurance providers, leading to higher premiums. Additionally, consultants who opt for higher coverage limits to protect themselves against substantial claims may face increased premiums to reflect the extended coverage provided.

Average Cost of E&O Insurance for US Consultants

When it comes to the average annual cost of Errors & Omissions (E&O) Insurance for US consultants, the typical amount hovers around $1,288 per year. This cost can vary based on several factors that influence the final premium.

Components Contributing to the $1,288/year Cost

- Professional Experience: Consultants with more experience may pay lower premiums as they are perceived as lower risk.

- Claims History: A history of past claims can lead to higher premiums as insurers see the consultant as a higher risk.

- Consulting Specialty: Different consulting specialties may have varying levels of risk, impacting the cost of E&O Insurance.

- Policy Limits and Deductibles: Higher coverage limits and lower deductibles can increase the cost of insurance.

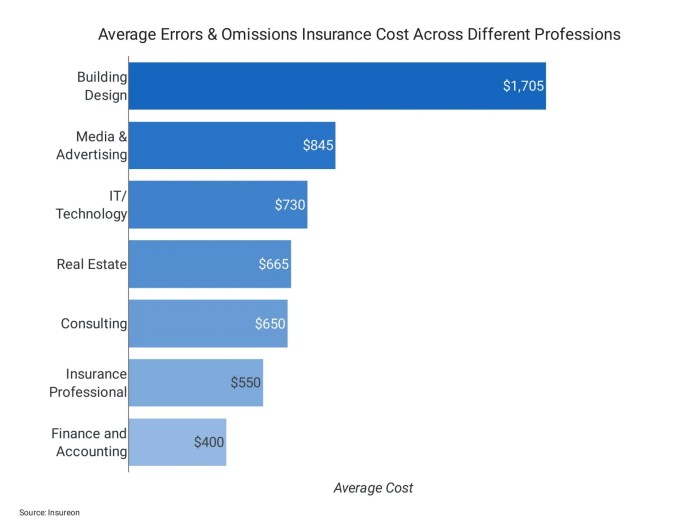

Comparison Across Different Consulting Specialties

Consulting specialties can greatly influence the average cost of E&O Insurance. For example, consultants in high-risk fields such as financial advising may pay more for coverage compared to consultants in lower-risk fields like marketing or design. The level of risk associated with the specialty plays a significant role in determining the final premium amount.

Strategies to Lower E&O Insurance Costs

When it comes to lowering E&O insurance costs, consultants can take proactive measures to reduce their premiums and overall expenses. By implementing risk management strategies and making informed decisions, consultants can effectively manage their insurance costs.

Role of Risk Management

Risk management plays a crucial role in reducing E&O insurance costs for consultants. By identifying potential risks and taking steps to mitigate them, consultants can demonstrate to insurers that they are proactive in minimizing the likelihood of claims. This can lead to lower premiums and better terms on their insurance policies.

- Implementing thorough client contracts that clearly Artikel responsibilities and expectations can help reduce misunderstandings and potential disputes.

- Regularly reviewing and updating internal processes and procedures can help identify areas of improvement and minimize errors that could lead to claims.

- Investing in employee training and continuing education to ensure that staff are up-to-date on industry best practices and standards.

- Maintaining open communication with clients throughout projects to address any issues or concerns promptly, reducing the likelihood of disputes.

Final Conclusion

Wrapping up the discussion on Errors & Omissions (E&O) Insurance Cost Breakdown: Why US Consultants Pay ~$1,288/Year, this closing paragraph summarizes the key points and leaves a lasting impression on the readers.

FAQ Section

What factors influence E&O Insurance costs?

Factors such as the type of consulting services, claims history, and coverage limits can impact E&O Insurance costs.

How can consultants reduce their E&O Insurance premiums?

Consultants can lower their E&O Insurance premiums by implementing risk management strategies and taking proactive measures to minimize insurance expenses.

What is the average annual cost of E&O Insurance for US consultants?

The average annual cost of E&O Insurance for US consultants is approximately $1,288.

How does E&O Insurance compare to other types of business insurance?

E&O Insurance is specifically tailored to protect consultants from claims of negligence or inadequate work, unlike other general business insurance policies.