Delving into the realm of Professional Liability Insurance Cost for Accountants & Mortgage Brokers (US Pricing Guide), this introduction sets the stage for a comprehensive exploration, ensuring a blend of informative insights and engaging discourse.

The following paragraph will provide a detailed and informative overview of the topic.

Overview of Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is a type of coverage that protects professionals such as accountants and mortgage brokers from financial losses resulting from claims of negligence, errors, or omissions in the services they provide.

This insurance is essential for these professionals as it helps cover legal expenses, settlements, and judgments that may arise from such claims.

Coverage Provided by Professional Liability Insurance

- Protection against claims of professional negligence

- Legal defense costs coverage

- Coverage for settlements or judgments

- Protection for reputation and assets

Significance of Having Professional Liability Insurance

Professional liability insurance is crucial for accountants and mortgage brokers as it provides a safety net against potential claims that could threaten their financial stability and reputation. In today's litigious environment, even the most diligent professionals can face allegations of errors or negligence.

Having this insurance ensures that they are protected and can continue their practice without the fear of significant financial loss in case of a claim.

Factors Affecting Professional Liability Insurance Cost

When it comes to professional liability insurance for accountants and mortgage brokers, there are several key factors that can influence the cost of coverage.

Type of Services Offered

The type of services offered by accountants and mortgage brokers can have a significant impact on insurance costs. Those who provide more complex services or work with high-risk clients may face higher premiums due to the increased likelihood of claims.

Experience Level and Claims History

An individual's experience level and claims history can also play a role in determining insurance premiums. Accountants and mortgage brokers with a proven track record of professionalism and few or no past claims are likely to pay lower premiums compared to those with a history of claims or legal issues.

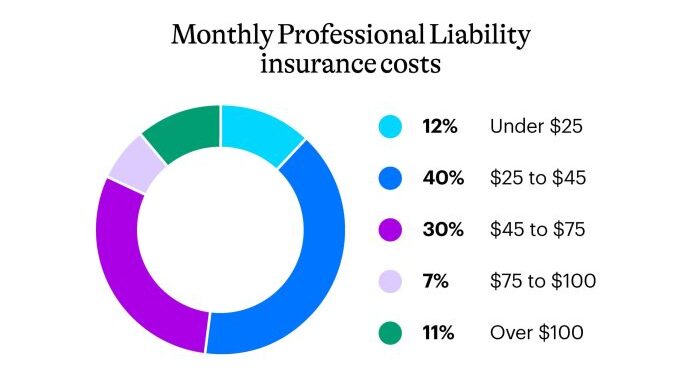

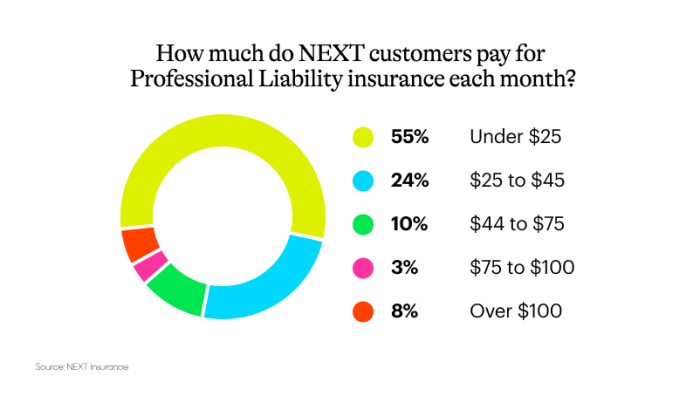

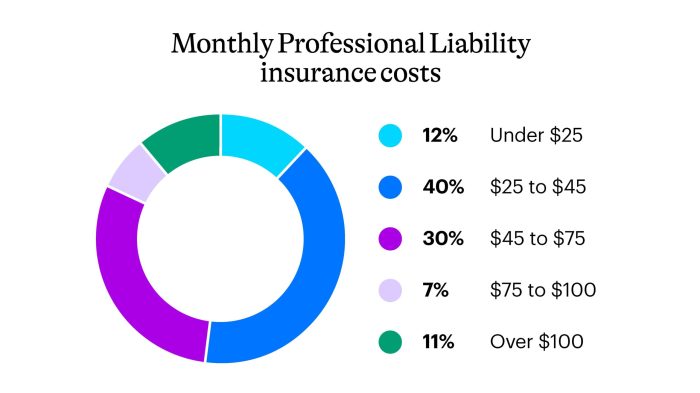

Average Costs and Pricing Guide in the US

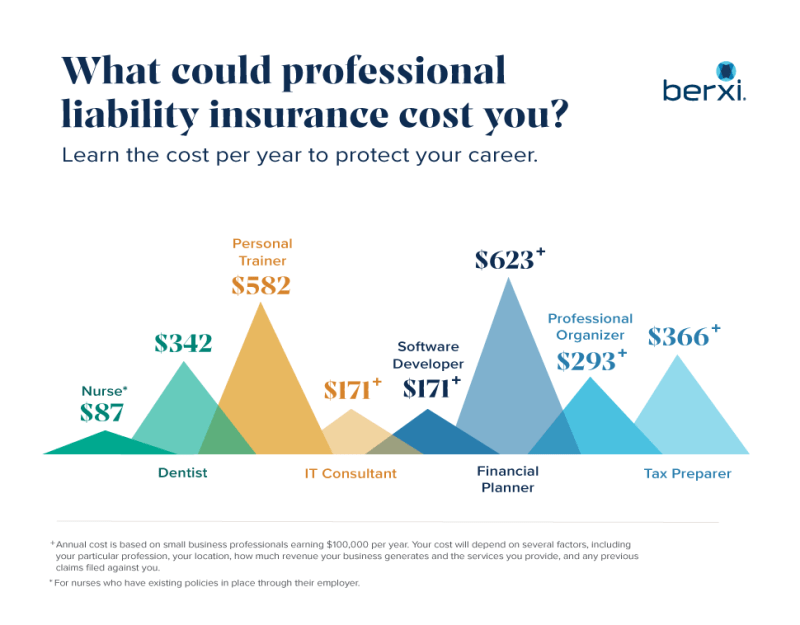

Professional liability insurance costs for accountants and mortgage brokers in the US can vary based on several factors. On average, accountants can expect to pay between $1,000 to $3,000 per year for coverage, while mortgage brokers may pay anywhere from $1,500 to $5,000 annually.

These costs can fluctuate based on specific coverage needs, business size, location, and claims history.

Comparison of Pricing Structures

When comparing pricing structures between different insurance providers, it's essential to look at the coverage limits, deductibles, and additional services offered. Some providers may offer lower premiums but have higher deductibles, while others may provide more comprehensive coverage at a higher cost.

It's crucial to evaluate the overall value and not just the price when selecting a professional liability insurance provider.

Industry-Specific Trends Impacting Costs

In the accounting industry, the increasing complexity of financial regulations and the rise in cybersecurity threats have led to higher insurance costs. Accountants handling sensitive financial data are at a higher risk of facing lawsuits, impacting their insurance premiums. For mortgage brokers, the volatility of the real estate market and changes in lending regulations can also affect insurance costs.

Staying informed about industry trends and implementing risk management strategies can help mitigate insurance expenses for both professions

Tips for Lowering Professional Liability Insurance Costs

Reducing professional liability insurance costs is crucial for accountants and mortgage brokers to maintain profitability and financial stability. By implementing effective risk management practices and taking proactive measures, professionals in these fields can minimize potential claims and lower their insurance premiums.

Implement Risk Management Practices

One key strategy for lowering professional liability insurance costs is to implement robust risk management practices. By identifying and addressing potential risks in their day-to-day operations, accountants and mortgage brokers can reduce the likelihood of claims being filed against them.

- Regularly review and update client contracts to clearly define responsibilities and expectations.

- Implement quality control procedures to ensure accuracy and consistency in work product.

- Provide ongoing training for staff to stay up-to-date on industry regulations and best practices.

Maintain Good Communication with Clients

Effective communication with clients is essential for preventing misunderstandings and potential disputes that could lead to professional liability claims. By maintaining open lines of communication and ensuring clients are well-informed throughout the engagement process, accountants and mortgage brokers can reduce the risk of claims being filed against them.

- Set clear expectations with clients regarding the scope of work, deadlines, and deliverables.

- Promptly address any client concerns or complaints to prevent escalation.

- Document all client interactions and decisions made to provide a clear record of communication.

Invest in Cybersecurity Measures

In today's digital age, cybersecurity threats pose a significant risk to professionals in the accounting and mortgage brokering industries. Investing in robust cybersecurity measures can help protect sensitive client data and reduce the risk of cyber-related professional liability claims.

- Implement encryption protocols to secure client information and prevent data breaches.

- Regularly update software and systems to address potential vulnerabilities and enhance cybersecurity defenses.

- Educate staff on cybersecurity best practices to prevent phishing scams and other cyber threats.

Closing Summary

Concluding this discussion on Professional Liability Insurance Cost for Accountants & Mortgage Brokers (US Pricing Guide) encapsulates the key points in a compelling manner, leaving readers with a lasting impression of the subject matter.

Answers to Common Questions

What factors can influence the cost of professional liability insurance for accountants and mortgage brokers?

Factors such as the type of services offered, experience level, and claims history can impact insurance costs.

How can accountants and mortgage brokers lower their professional liability insurance costs?

They can lower costs by implementing risk management practices and taking proactive measures to minimize potential claims.

What is the average cost of professional liability insurance for accountants and mortgage brokers in the US?

The average costs vary and depend on different factors, with pricing structures differing among insurance providers.