Exploring the potential savings of up to $1,273 with State Farm Home Insurance vs. GEICO Auto Bundling (US Comparison) sets the stage for a detailed comparison that delves into the world of insurance bundling. This comparison promises insights into how bundling home and auto insurance can lead to significant cost savings while providing comprehensive coverage.

Introduction to State Farm Home Insurance and GEICO Auto Bundling

When it comes to insurance, bundling your policies can lead to significant savings. This practice involves combining multiple insurance policies, such as home and auto insurance, with the same provider to receive a discount on the overall premium.

State Farm and GEICO are two well-known insurance companies in the United States that offer bundling options for home and auto insurance. State Farm is recognized for its extensive coverage options and personalized service, while GEICO is known for its competitive rates and user-friendly online tools.

Potential Savings with Bundling

By bundling your home and auto insurance policies with State Farm or GEICO, you can potentially save up to $1,273 annually, depending on various factors such as your location, driving record, and home value. These savings can make a significant difference in your overall insurance costs.

Benefits of Bundling Policies

- Convenience: Managing multiple insurance policies with one provider simplifies the process and reduces the likelihood of overlooking important details.

- Cost-Effective: Bundling discounts can result in lower premiums for both home and auto insurance, ultimately saving you money in the long run.

- Coverage Consistency: Having both policies with the same insurer ensures consistency in coverage and simplifies the claims process in case of an incident that involves both your home and vehicle.

- Add-On Options: Some insurers offer additional benefits or discounts for policyholders who bundle their insurance, further maximizing the value of your coverage.

Coverage Offered by State Farm Home Insurance

State Farm Home Insurance provides a range of coverage options to protect homeowners from various risks and liabilities.

Types of Coverage

- Dwelling Coverage: This type of coverage protects the structure of your home from damages caused by covered perils such as fire, windstorm, or vandalism.

- Personal Property Coverage: It covers your personal belongings such as furniture, clothing, and electronics in case they are damaged or stolen.

- Liability Coverage: Protects you in case someone is injured on your property and you are found legally responsible for their injuries.

Additional Coverage Options

- Personal Liability Umbrella Policy: State Farm offers additional liability coverage beyond the limits of your standard policy to protect you from high-cost lawsuits.

- Flood Insurance: Homeowners can add flood insurance to their policy to protect against flood-related damages, which are not covered under standard policies.

Comparison to Other Insurance Providers

State Farm's coverage options are comprehensive and competitive compared to other insurance providers in the market. The company offers customizable policies to fit the specific needs of homeowners and provides excellent customer service and claims handling.

Coverage Offered by GEICO Auto Insurance

When it comes to auto insurance coverage, GEICO offers a variety of options to meet the needs of different drivers. Let's take a closer look at the types of coverage available in GEICO auto insurance policies.

Types of Coverage

- Liability Coverage: This type of coverage helps pay for injuries and property damage that you cause to others in an accident.

- Collision Coverage: Covers the cost of repairing or replacing your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Provides coverage for damage to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

Additional Coverage Options

- Medical Payments Coverage: Helps pay for medical expenses for you and your passengers in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are involved in an accident with a driver who doesn't have insurance or enough insurance to cover your damages.

- Rental Reimbursement Coverage: Helps pay for a rental car if your vehicle is being repaired due to a covered loss.

Comparison to Other Auto Insurance Providers

When comparing GEICO's coverage options to other auto insurance providers, GEICO stands out for its competitive rates and customizable coverage options. With a reputation for excellent customer service and a wide range of discounts available, GEICO is a popular choice for many drivers looking for reliable auto insurance coverage.

Pricing and Discounts

When it comes to choosing between State Farm Home Insurance and GEICO Auto Bundling, pricing and discounts play a significant role in decision-making. Let's delve into the specifics of how these two insurance providers compare in terms of cost and savings.

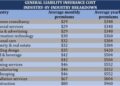

Average Cost of Home Insurance at State Farm

At State Farm, the average cost of home insurance can vary depending on multiple factors. These factors include the location of the property, the age and condition of the home, the coverage limits selected, and the policyholder's claims history.

Factors Influencing Home Insurance Premiums

The cost of home insurance premiums at State Farm is influenced by various factors. These factors may include the size of the property, the materials used in construction, the presence of security features such as alarms or cameras, and the policyholder's credit score.

Discounts for Bundling Home and Auto Insurance at State Farm

State Farm offers discounts for policyholders who choose to bundle their home insurance with auto insurance. By combining these policies, customers can save money on their overall insurance costs. The specific discount amount may vary depending on the coverage options selected and the individual policyholder's circumstances.

Comparison with GEICO’s Auto Insurance Rates

When comparing the pricing and discounts of State Farm Home Insurance with GEICO's auto insurance rates, it's essential to consider the overall savings potential. While GEICO may offer competitive rates for auto insurance, State Farm's bundling discounts can result in significant savings for policyholders who opt for both home and auto coverage with the same provider.

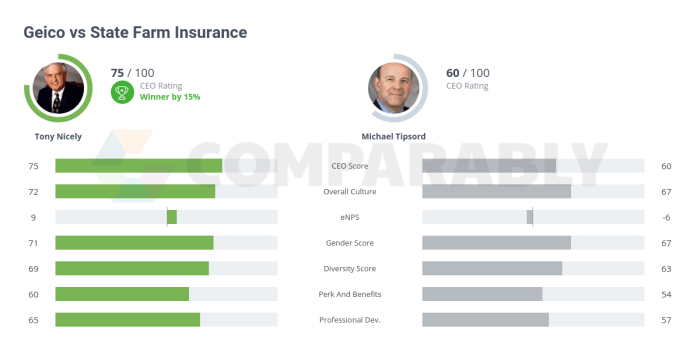

Customer Satisfaction and Reviews

When it comes to insurance, customer satisfaction is a crucial factor in determining the reliability and quality of service provided by an insurance company. Let's take a closer look at the customer satisfaction and reviews for State Farm home insurance and compare it to GEICO's auto insurance.

State Farm Home Insurance Customer Reviews

- State Farm has received mixed reviews from customers regarding their home insurance policies.

- Some policyholders praise State Farm for their excellent customer service and prompt claims processing.

- However, there have been complaints about rate increases and difficulty in reaching customer service representatives.

- Overall, State Farm has a decent customer satisfaction rating, with many customers satisfied with their coverage and claims experience.

Customer Service Experience with State Farm

- State Farm is known for its personalized customer service and dedicated agents who assist policyholders throughout the claims process.

- Customers appreciate the ease of filing claims with State Farm and the quick resolution of issues.

- However, some customers have reported delays in claims processing and challenges in communication with State Farm representatives.

- Overall, State Farm's customer service is considered reliable and efficient by many policyholders.

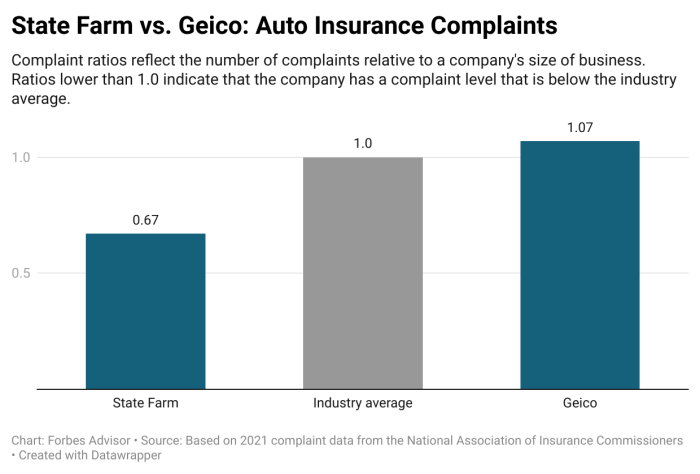

Comparison to GEICO Auto Insurance Customer Reviews

- GEICO is well-regarded for its affordable auto insurance rates and user-friendly online tools.

- Customers often praise GEICO for its quick claims processing and responsive customer service.

- However, some policyholders have raised concerns about rate increases and difficulties in reaching GEICO's customer service team.

- Overall, GEICO has a high customer satisfaction rating, with many customers satisfied with their auto insurance coverage and service experience.

Final Review

In conclusion, the discussion on Save Up to $1,273: State Farm Home Insurance vs. GEICO Auto Bundling (US Comparison) sheds light on the advantages of bundling insurance policies, highlighting the financial benefits and coverage options available. This comparison serves as a valuable guide for those looking to optimize their insurance plans and maximize savings.

FAQ Overview

What discounts are available when bundling home insurance with auto insurance at State Farm?

State Farm offers discounts for customers who bundle their home insurance with auto insurance, potentially saving up to $1,273. These savings can vary based on individual circumstances and the coverage options selected.

What are the common complaints from State Farm policyholders in terms of customer service?

Common complaints from State Farm policyholders regarding customer service include issues with claim processing times, communication delays, and difficulty reaching representatives.