As State Farm Auto Insurance Discounts Explained: How to Maximize the 25% Multi-Policy Savings takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The following paragraphs will provide descriptive and clear information about the topic

Understanding State Farm Auto Insurance Discounts

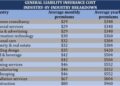

When it comes to auto insurance, discounts play a crucial role in helping policyholders save money on their premiums. State Farm offers a variety of discounts to their customers, allowing them to maximize their savings and get the coverage they need at an affordable price.

Types of Discounts Offered by State Farm

- Multi-Policy Discount: By bundling your auto insurance with another policy, such as homeowners or renters insurance, you can save up to 25% on your premiums.

- Good Driver Discount: If you have a clean driving record with no accidents or traffic violations, you may qualify for a discount.

- Good Student Discount: Students who maintain a high GPA can benefit from lower insurance rates.

- Vehicle Safety Features Discount: Installing safety features like anti-lock brakes or airbags can help lower premiums.

Examples of How Discounts Can Lower Insurance Premiums

For instance, if you bundle your auto insurance with your home insurance policy, you could save hundreds of dollars each year. Similarly, if you are a good student and maintain a high GPA, you may be eligible for a discount that significantly reduces your premiums.

Additionally, by equipping your vehicle with safety features, you not only ensure your safety but also qualify for lower insurance rates.

Multi-Policy Savings with State Farm

When it comes to insurance, multi-policy savings refer to the discounts offered when a customer combines multiple insurance policies with the same provider. State Farm, like many other insurance companies, offers significant savings to customers who choose to bundle their auto insurance with other types of coverage.

Benefits of Multi-Policy Savings

- Customers can save up to 25% on their auto insurance premium by bundling with other policies such as home, renters, or life insurance.

- Combining policies can simplify the insurance process by having all coverage under one provider, making it easier to manage and keep track of.

- Having multiple policies with State Farm can also lead to better customer service and more personalized attention from the insurer.

Maximizing the 25% Multi-Policy Savings

When it comes to maximizing the 25% multi-policy savings with State Farm auto insurance, there are specific steps you can take to make sure you're getting the most out of this discount. By combining your auto insurance policy with another type of insurance, such as homeowners or renters insurance, you can unlock significant savings on your premiums.To maximize the 25% multi-policy savings, follow these steps:

Comparing Savings with and without the Multi-Policy Discount

- Without the multi-policy discount, you would be paying separate premiums for each insurance policy you have with State Farm. This can add up to a significant amount over time.

- With the 25% multi-policy discount, you can save a substantial portion of your premium costs by bundling your auto insurance with another policy.

Designing a Strategy to Take Full Advantage of the Discount

- Start by evaluating your insurance needs and determining which additional policy, such as homeowners or renters insurance, you can bundle with your auto insurance.

- Reach out to a State Farm agent to discuss the available options and ensure you are maximizing the discount based on your specific situation.

- Review your policies annually to see if there are any changes or updates that can further increase your savings through the multi-policy discount.

- Consider adding more policies over time to increase your overall savings with State Farm's multi-policy discount.

Final Thoughts

In conclusion, the discussion on State Farm Auto Insurance Discounts Explained: How to Maximize the 25% Multi-Policy Savings offers a compelling summary and closing thoughts on the subject.

Key Questions Answered

Question?

Answer

Include FAQs and answers for State Farm Auto Insurance Discounts Explained: How to Maximize the 25% Multi-Policy Savings