Delving into the intricacies of Workers’ Comp Insurance Class Codes and how they impact premiums, this piece sheds light on strategies for US employers to optimize their costs and avoid overpayment.

From understanding the classification nuances to practical tips for accurate assessment, this narrative is a comprehensive guide for navigating the complexities of insurance premiums.

Overview of Workers’ Comp Insurance Class Codes

Workers’ Comp Insurance Class Codes are codes assigned to different job types to classify the level of risk associated with each occupation. These codes help insurance companies determine the appropriate premium rates for coverage.

Importance of Correctly Classifying Employees

- Accurately classifying employees ensures that each worker is assigned the correct level of risk, which directly impacts the cost of insurance premiums.

- Incorrect classification can result in overpaying or underpaying premiums, leading to financial consequences for employers.

- Proper classification also helps insurance companies assess the overall risk exposure of a business accurately.

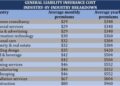

How Class Codes Impact Insurance Premiums

- Class Codes play a crucial role in determining the base rate for workers’ compensation insurance premiums.

- Higher-risk job classifications are assigned higher premium rates, reflecting the increased likelihood of workplace injuries or accidents.

- Employers with a low-risk workforce may benefit from lower premium rates based on their employees’ classifications.

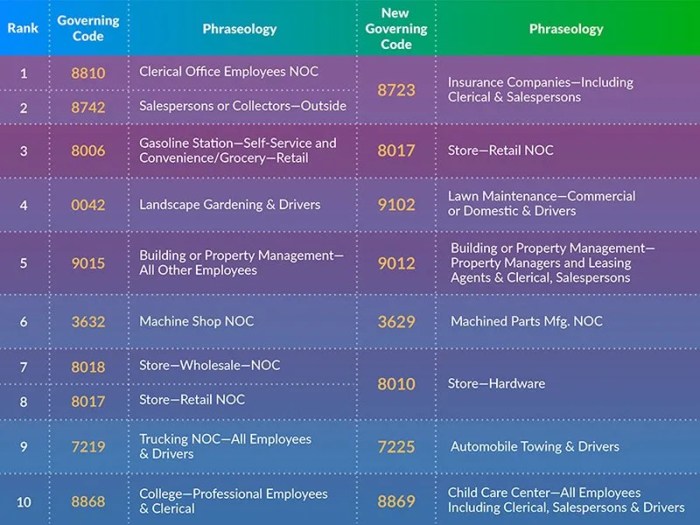

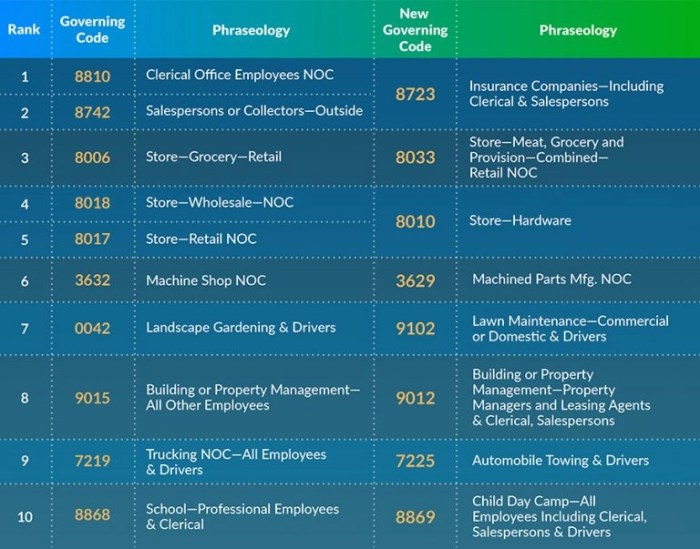

Examples of Common Class Codes and Their Descriptions

| Class Code | Description |

|---|---|

| 8742 | Salesperson – Outside |

| 5022 | Masonry – Non-Structural |

| 8810 | Clerical Office Employees |

Factors Influencing Class Codes

When it comes to determining an employee's classification for Workers' Comp Insurance Class Codes, several factors come into play. Let's explore how industry type, job duties, and risks can impact these classifications.

Industry Type and Class Codes

Industry type is a key factor in determining Class Codes. Different industries have varying levels of risk associated with them, which directly affects the classification of employees within those industries. For example, employees working in construction are classified differently than those in an office setting due to the higher risks involved in construction work.

Job Duties and Classification

The specific job duties that an employee performs also play a significant role in determining their classification. Jobs that involve more physical labor or potential hazards are typically classified differently than desk-based roles. For instance, a construction worker would have a different Class Code than a receptionist.

Impact of Risks on Classification

The level of risk associated with a particular job is a crucial factor in classifying employees. Jobs with higher risks of injury or illness are classified differently to reflect the increased likelihood of Workers' Comp claims. For example, a firefighter would have a different Class Code than a librarian due to the higher risks involved in firefighting.

How Employers Can Avoid Overpaying Premiums

Employers can take several steps to avoid overpaying premiums for Workers’ Comp Insurance. By accurately classifying employees, conducting regular audits, and reviewing and updating Class Codes when necessary, employers can ensure they are paying the correct amount for insurance coverage.

Additionally, implementing strategies to reduce costs through proper classification can lead to significant savings

Strategies for Accurately Classifying Employees

- Consult with insurance carriers or agents to understand the specific requirements for each Class Code.

- Educate employees on the importance of accurate reporting and classification to avoid errors.

- Regularly review job duties and responsibilities to ensure they align with the assigned Class Code.

- Seek guidance from industry experts or consultants to assist in proper classification.

Role of Audits in Ensuring Correct Class Codes

- Conduct internal audits to identify any discrepancies or misclassifications in Class Codes.

- Work with insurance auditors to review past classifications and make necessary corrections.

- Implement a system for ongoing audits to catch any errors or changes in classification over time.

Reviewing and Updating Class Codes When Necessary

- Regularly review Class Codes to ensure they accurately reflect the current job duties and responsibilities of employees.

- Update Class Codes when there are changes in job roles, tasks, or industry standards that may impact classification.

- Communicate any updates to insurance carriers to ensure accurate premium calculations.

Tips for Reducing Workers’ Comp Insurance Costs Through Proper Classification

- Invest in safety training and programs to reduce the risk of workplace injuries and claims.

- Implement return-to-work programs to help injured employees get back to work sooner, minimizing claim costs.

- Explore alternative insurance options or programs that may offer cost-saving opportunities based on accurate classification.

- Monitor and track claims data to identify trends and areas for improvement in classification and risk management.

Outcome Summary

As we conclude this exploration of Workers’ Comp Insurance Class Codes, it becomes evident that a nuanced approach to classification can significantly impact an employer's bottom line. By implementing the right strategies and staying informed, US employers can effectively manage their premiums and ensure financial stability.

User Queries

How do Class Codes impact insurance premiums?

Class Codes directly influence the premium rates employers pay for Workers’ Comp Insurance. Incorrect classification can lead to overpayment or underpayment, affecting the overall cost.

What role do audits play in ensuring correct Class Codes?

Audits are essential for verifying the accuracy of Class Codes. They help in detecting any discrepancies and ensuring that employees are correctly categorized, thereby preventing financial losses.

How can employers reduce Workers’ Comp Insurance costs through proper classification?

Employers can lower insurance costs by accurately classifying employees based on their job duties and risks, ensuring that they are placed in the most appropriate Class Codes for fair premium assessment.